Trade Crude Oil and Natural GasDiscover enormous trading opportunities coming from the biggest markets

Diversify your portfolio with safe haven assets, which minimize risks due to their instinct value.

Commodities are raw materials used to produce finished goods, such as agricultural products, mineral ores, and fossil fuels. Commodities are physical goods that are bought, sold, and traded in financial markets, as opposed to securities, which exist solely as financial contracts.

Energy: Oil, natural gas, coal, ethanol, and even uranium are all part of the energy market. Renewable energy sources such as wind and solar power are also included in the power of energy.

Metals: Precious metals such as gold, silver, palladium, and platinum are examples of commodity metals, as are industrial metals such as iron ore, tin, copper, aluminum, and zinc.

Agricultural Products: Agriculture includes both edible products like cocoa, grain, sugar, and wheat, as well as non-edible products like cotton, palm oil, and rubber.

Livestock: All live animals, such as cattle and hogs, are considered livestock.

Commodity trading is the exchange of various assets, usually futures contracts, based on the price of an underlying physical commodity. Investors make bets on the expected future value of a commodity by buying or selling futures contracts. If they believe the price of a commodity will rise, they purchase specific futures contracts (or go long), and if they believe the price will fall, they sell other futures contracts (or go short).

Commodities trading works in the same manner that any other market does, in that buyers and sellers meet to exchange goods. The sole distinction is that commodities may be purchased and sold at both current and future prices.

Indice Training guide to help you better

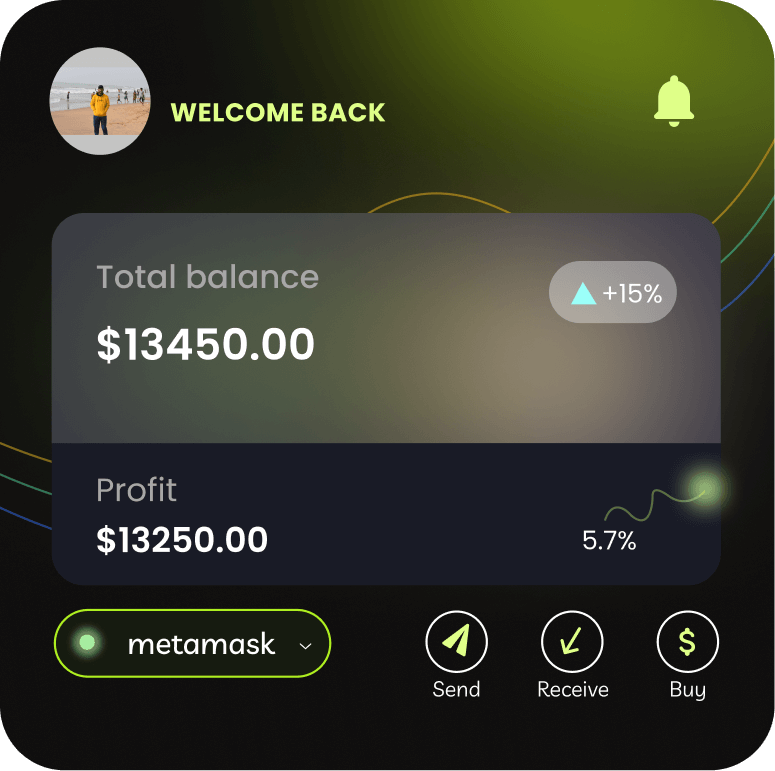

Accepting all bank cards, ensuring seamless and hassle-free transactions worldwide.

Discover Unlimited Trading Opportunities Across 4600+ Global Markets

Trading Products

Trading Tools

About Us

©LaRockGroup, All rights reserved.